Digital onboarding. Safe, fluid, stress-free.

Protect every identification from fraud and deepfakes, automate your processes, and deliver smooth, reliable digital experiences, all from one powerful, all-in-one platform powered by AI.

con i nostri servizi di onboarding digitale evoluto

We automate the way you connect with your customers

An operational flow that links your business to its clients, smoothly, efficiently, and with measurable results.

Who already trusts us

We’re a trusted technology partner for the organisations that choose us, and we’re committed to growing that trust every day.

A cosa serve l’onboarding

Costruiamo la soluzione su misura in base alle effettive esigenze di ogni cliente

Our solutions

A modular and streamlined operational flow

How we use Artificial Intelligence

Our identification services are powered by proprietary, patented AI solutions that automate the collection and recognition of identities and documents.

Fast and precise recognition:

AI at the service of identity

Advanced technology for quick and secure identification

AI and deep learning analyze documents and faces in real time, ensuring security and precision. We support document verification and face recognition for fast and secure digital identification. We reduce the risk of error and increase user trust in every scenarios. A complete solution for authentication, compliance and secure onboarding.

Intelligent Automation: Eliminating Human Error with AI

Save time and reduce errors with intelligent data automation

The AI technology compiles data from documents and forms with maximum accuracy, eliminando eliminating human errors. Optimize processing times and reduce manual load, freeing up resources for strategic tasks. Data precisione is guaranteed and processes are faster and more scalable. Perfect for those looking for reliability and high performance in digital processing.

Real-time assistance:

intuitive procedures and instant corrections

A simple and error-free process, guided at every stage thanks to AI

Guided procedures and automatic fixes reduce errors and speed up processes. Artificial intelligence provides precise indications in real time, improving customer experience without interruptions. Thanks to continuous support, every phase becomes simple, intuitive and error-free. Increase operational efficiency and offer smoother service to your customers.

Who we serve

All sectors subject to anti-money laundering regulations, or those looking to digitalise their relationship with users and end customers.

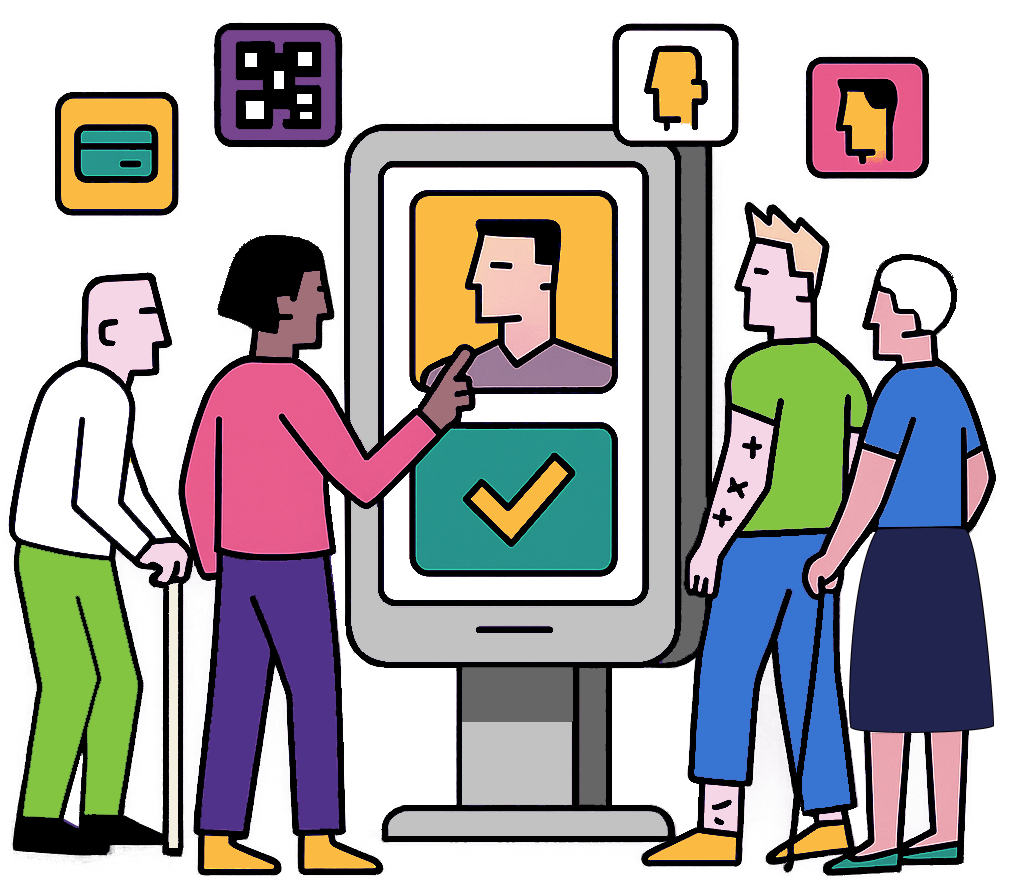

Digital inclusion, always

Our solutions enable anyone, regardless of the type of document they hold, their familiarity with technology, or their knowledge of digital tools, to be recognised, identified and use our services in a simple and secure way.

Inclusion and accessibility are not just values, but a concrete responsibility we embrace at every stage of the digital transformation.

Our experience at your service

Technology and expertise for a secure, end-to-end onboarding experience.

Our certification

Certified in our work to offer you the highest standards of quality and security in every tool and solution.

ETSI EN 319 411-1 V1.4.1

ETSI EN 319 411-2 V2.5.1

ETSI TS 119 461 V1.1.1

Explore the solution

Get in touch and discover how INEO’s services can support your business.